You might have heard about the term NFTs, currently taking the world of digital art and collectibles by storm. You might even know that NFT stands for “Non-Fungible Token.” But do you really know what NFTs actually are? Why artists, creators, pop culture stars, and businesses are vigorously trying to get their hands on this?

When everybody across the globe believed Bitcoin was a concrete form of digital currency, NFTs pitched in as the digital answer to collectibles. As a result, digital artists see their lives transforming due to massive sales to a new crypto-audience.

The sales of NFTs surged to $25 billion in 2021 as the crypto asset blew up in popularity, powered by the growing interest of celebrities and tech evangelists, according to the DappRadar data analytics. But the question remains: Are NFTs worth the money, or is it just the hype?

Some experts and market professionals say they are just a bubble poised to pop somehow. Others believe NFTs are here to stay and will change financing forever. But we cannot predict anything about what the future holds.

Still, numerous questions keep bouncing in your mind, like what are non-fungible tokens, and what makes them unique? How do they work? How to buy NFTs? How are they different from cryptocurrency? Who can buy NFTs? And so on.

If you are curious about these questions and want to explore more about what NFTs are all about, you landed at the right place! So, without any further ado, let’s start with the NFTs meaning.

What Are NFTs?

Anything that can be converted into a digital form can be a non-fungible token. That does not really explain the NFT meaning, Right? So everything from your paintings, photographs, videos, music, GIFs, in-game items, selfies, and even a tweet can turn out to be an NFT, which can be traded online using cryptocurrency.

Although NFTs have been around since 2014. It is gaining popularity because it is a progressively standard way to buy and sell digital artwork. If we talk about figures, according to Coindesk, a staggering $174 million has been spent on NFTs since November 2017.

To understand the NFT meaning better Arry Yu states that “NFTs are usually unique, or one of a minimal run, and have special recognizing codes. Fundamentally, NFTs make digital scarcity”. This stands in unambiguous contrast to most digital creations, which are always unlimited in supply. So, theoretically, stopping the supply should enhance the value of a particular asset, believing it’s in demand.

But several NFTs, in this initial period, have been digital creations that already exist elsewhere in some form, like iconic video clips from NBA games or securitized versions of digital art that are already sailing all over on Instagram.

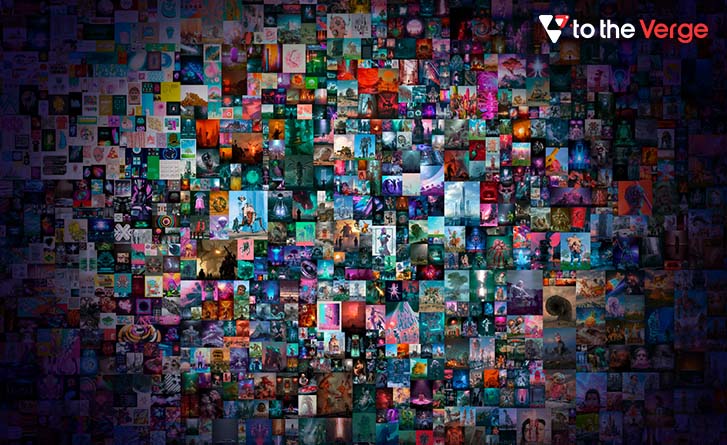

For example, well-known digital artist Mike Winklemann, better known as “Beeple,” created a composite of 5,000 daily drawings to build possibly the most popular NFT of the instant, “EVERYDAYS: The First 5000 Days,” which got sold at Christie’s for $69.3 million.

Anyone can see the specific images or even the whole collage of images online free of cost. So why are people ready to spend millions on something that they could easily take a screenshot of or can easily download?

Because an NFT allows the purchaser to have sole ownership of the original article, it contains in-built authentication, which acts as ownership proof. Collectors value those “digital bragging rights” nearly above the item itself.

“By building an NFT, creators can authenticate scarcity and legitimacy to anything digital,” says Solo Ceesay, co-founder and COO of Calaxy.” For example, there are infinite copies of the painting Mona Lisa on the market, but there is only one original piece. NFT technology helps allocate the ownership of the original article.”

But what’s so unique about NFTs that makes them different from other digital forms? The answer is simple. It is backed by Blockchain technology – a distributed ledger where all transactions are documented or recorded. It is like your bank passbook, where all your transactions are transparent and can be seen by anyone but cannot be changed or customized once noted.

Talking about the origin, Terra Nulius was the first NFT for sale on Ethereum Blockchain, although this project was merely an idea that only permitted to customize a short message recorded on the Blockchain. Then came Curio Cards, CryptoPunks, and CryptoCats in 2017, before NFTs gradually shifted into public awareness, then growing into mainstream acceptance in early 2021.

Selling NFTs has been a profitable business globally. Here are some of the popular examples you might have heard about:

- Twitter founder Jack Dorsey’s first tweet was sold as NFT for USD 2.9 Million.

- World Wide Web inventor Sir Tim Berners Lee sold the source code containing 9,555 lines as NFT for USD 5.4 Million.

- Leading Metaverse company Decentraland has tokenized everything from avatars to usernames to in-game wearables to real estate. Sotheby’s, the world’s largest fine art auction house, opened its first Metaverse location by purchasing a block of land as an NFT in Decentraland, where players can wander into the gallery and buy the NFTs that the gallery has put for sale.

- Journalist Kevin Ross’ article on NFTs was sold as NFT for USD 560,000.

- The Charlie Bit My Finger video with 880 Million views on YouTube was sold off as NFT for USD 760,000.

- Mark Cuban sold his inspirational quote as NFT for USD 1,700.

- Andres Reisinger, an Argentinian designer, sold ten pieces of his furniture as NFTs for USD 450,000.

These examples of NFT sales are just the tip of the iceberg. This proves that anything with authenticated ownership can be sold as NFT via Metaverse space for a profit. And by anything, we do mean anything, and the possibilities are endless. It’s just what one’s mind can conceive as sell-worthy, and boom! You can create it and put your NFTs for sale. Now that you might have some idea about what is an NFT? So let’s get into how does an NFT work?

READ LATEST INFORMATION: NFTs Will Come To Instagram Soon: Announces Meta’s CEO Mark Zuckerberg

How Does an NFT Work?

Now that you have started understanding what is an NFT, let’s put our next step to find out how NFT works? NFT works on Blockchain technology as it provides complete ownership of a digital asset to the users. For example, if you are a sketch artist and want to convert your digital asset to an NFT, you get proof of ownership powered by Blockchain.

NFTs are usually held on the Ethereum blockchain, although other blockchains also support them. An NFT is created or “minted” from digital items that signify both tangible and intangible things, including:

- Art

- GIFs

- Virtual avatars and video game skins

- Videos and sports highlights

- Collectibles

- Music

Even tweets count. We have already discussed that Twitter co-founder Jack Dorsey’s first-ever tweet sold as an NFT for more than $2.9 million. Basically, NFTs are like physical collector’s items in digital form. So rather than getting an actual oil painting to hang on the wall, the buyer receives a digital file instead with exclusive ownership rights. That’s correct: NFTs can have only one sole owner at a time.

NFTs’ exclusive data makes it comfortable to authenticate their ownership and transfer tokens between owners. The owner or creator can also collect detailed data within them. For example, artists can sign their artwork with their signature in an NFT’s metadata.

So when you list your NFT for sale on a marketplace, you have to pay a gas fee or transaction fee for using the Blockchain technology. Your digital art is then documented on Blockchain, stating that you own the specific NFT. This provides you with complete ownership, which no one can modify, including the marketplace owner.

know more about NFTs and Metaverse

What Are NFTs Used For?

NFTs offer artists and content creators a unique opportunity to monetize their pieces of stuff. For example, artists no longer need to depend on art galleries or auction houses to sell their artwork. Instead, they can sell it directly to the customer as an NFT, letting them keep more of the profits.

In addition, artists can plug in royalties to receive a percentage of sales whenever their art is sold to a different owner. This is a fantastic feature as artists usually do not get future profits after first selling their art.

So if you are wondering, what if you are not an artist? But the artwork isn’t the only way to make money with NFTs. Brands like Taco Bell and Charmin have auctioned off themed NFT art to raise capital for charity. Charmin named its offering “NFTP” (non-fungible toilet paper), and Taco Bell’s NFT artwork sold out, with the maximum bids coming in at 1.5 wrapped ether (WETH), equivalent to $3,723.83 at the time of writing.

Nyan Cat, a GIF of a cat with a pop-tart body, sold for $600,000. And NBA Top Shot produced over $500 million in sales in late March. A single LeBron James highlight NFT raised above $200,000. People keen on Crypto-trading and people who like to gather artwork frequently use NFTs. Other than that, it has some other uses mentioned below:

Digital Content

The most significant use of NFTs these days is in digital content. Content creators see their returns enriched by NFTs as they have the ownership of their content over to the platforms they use to publish it.

Gaming Items

NFTs have noticed a lot of attention from game developers. This is because NFTs can offer numerous benefits to the players. For example, you can buy items for your game, and when you’re done with that, you can earn back your money by selling them.

Domain Names

NFTs provide your domain with an easier-to-memorize name. This works similar to a website domain name, creating its IP address more notable and valued, usually based on size and relevance.

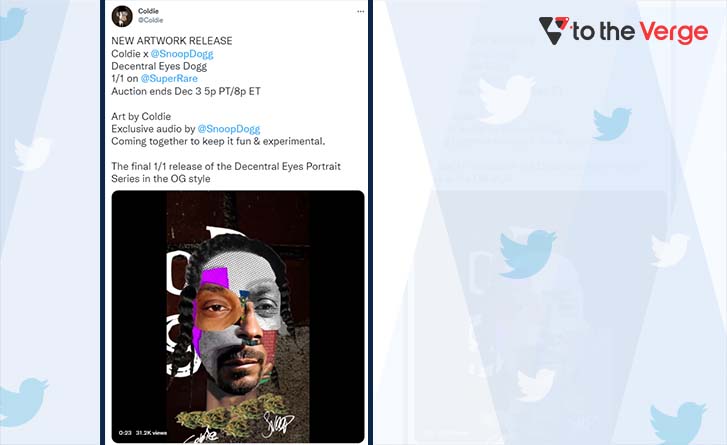

Even celebrities like Snoop Dogg and Lindsay Lohan are jumping on the NFT bandwagon, publicizing exclusive memories, artwork, and moments as NFTs.

Investment and Collaterals

Both NFT and DeFi (Decentralized Finance) share the same infrastructure. DeFi applications allow you to borrow money by using collateral. NFT and DeFi works together to explore using NFTs as collateral as an alternative.

Who can Buy NFTs?

So, if you have got this far, and got familiar with the NFT meaning and how does it work? You might have this question in your mind: can I make an NFT? Of course, anyone would assume so, as when Trevor Andrew drew this Gucci Ghost, he managed to sell it for $3,600. To be precise, anyone can create a piece of artwork, turn it into an NFT on the Blockchain with a process called ‘minting,’ and put up your NFT for sale on a marketplace of your choice.

You can also assign a commission to the file, which will pay you every time someone purchases the piece via resale. Much like when buying NFTs, you need to set up a wallet, and it has to be stuffed full of cryptocurrency. It’s this necessity for upfront money that causes the problems.

The hidden charges can be excessively astronomical, with sites charging a ‘gas’ fee for every sale, along with a price for selling and buying. You also need to consider conversion fees and variations in charge depending on the time of day. This means that the costs can often turn out to be much more than the price you get for selling the NFT.

So, whether or not NFTs are here to stay, they are making some people money and creating new possibilities for digital art. As it is clear that anyone can create and buy NFTs, it is essential to know how you can buy NFTs. Let’s dive in.

How to Buy NFTs

So, if you are eager to know how to buy NFTs and are interested in starting your NFT collection, you will have to obtain some essential items. Firstly, you’ll need a digital wallet that enables you to collect NFTs and cryptocurrencies. Next, you will likely require to buy some cryptocurrency, depending on what currencies your NFT provider accepts.

You can purchase cryptocurrency using a credit card on platforms like Coinbase, Kraken, eToro, and even PayPal and Robinhood. You will then be capable of moving it from the exchange to your wallet of choice.

You’ll need to keep the charges in mind too as you research the options. Most exchanges charge a percentage of your transaction when purchasing crypto. So if you are wondering where to buy NFTs. Let’s explore some popular NFT marketplace.

Popular NFT Marketplaces

Once your wallet is set up and funded, there’s no limitation on NFT sites to shop. Presently, some of the popular and leading NFT marketplaces are:

OpenSea.io

Publicized as the leading NFT marketplace, you can find digital art here. There are collectibles, including domain names, game items, and even digital representations of physical assets at OpenSea. Basically, the platform is like eBay for NFTs, with billions of digital assets organized into hundreds of categories. All you have to do is create an account to browse NFT collections to get started. You can also sort pieces by sales volume to discover new artists.

Rarible

Like OpenSea, Rarible is an independent, open NFT marketplace that allows artists and creators to issue and sell NFTs. In addition, RARI tokens issued on the platform enable holders to contribute to features like fees and community guidelines.

Foundation

This is a unique NFT marketplace where artists have to receive “upvotes” or an invitation from fellow creators to post their artwork. With the community’s exclusiveness and entry cost, artists have to buy “gas” to mint NFTs, which means it may boast greater-caliber artwork.

For example, Nyan Cat creator Chris Torres sold the NFT on the Foundation platform. It may also mean higher prices are not necessarily bad for artists and collectors looking to take advantage of them, assuming that the demand for NFTs remains in progress or increases over time.

Although these are some platforms that act as hosts to thousands of NFT creators and collectors, do your research thoroughly before buying. Some artists have fallen victim to imitators who have listed and sold their work without their authorization.

In addition, the authentication procedures for creators and NFT listings aren’t constant across platforms. Some are more stringent than others. For example, OpenSea and Rarible do not need owner authentication for NFT listings. Buyer securities appear to be at best, so when buying NFTs, it may be best to keep the saying “caveat emptor” (let the buyer beware) in mind.

How Is An NFT Different From Cryptocurrency?

NFTs are usually developed using the same kind of programming as cryptocurrency, but that’s where the similarity ends.

Physical money and cryptocurrencies are “fungible,” which means we can exchange them for one another. In addition, they are also equal in value. For example, one Dollar is always worth another Dollar, or one Bitcoin is always similar to another. Crypto’s fungibility makes it a reliable means of guiding transactions on the Blockchain.

NFTs are different compared to cryptocurrencies. Each NFT contains a digital signature that makes it unviable to be exchanged or equal – hence, non-fungible. So, for example, one NBA Top Shot clip is not similar to EVERYDAYS because they’re both NFTs. In addition, every art is different from others, making it non-fungible and unique.

Although a lot of money is being made in the NFT market, you’ll have also heard that there’s some risk associated with NFTs. So let’s find out what these risks are and how we can be overcome them.

Risks Associated With NFT

Just because you can buy NFTs, does that mean you have to? It depends on multiple conditions, Arre Yu says. “NFTs can be sometimes risky since their future is indefinite, and we don’t have a lot of history so far to evaluate their operation,” she added. “Since NFTs are so new and fresh in the market, it would be worth it if you invest in small amounts just to try it out for now.”

In other words, investing in NFTs is a primarily personal decision. It may be worth it if you have money to spare or invest, especially if an article holds some meaning. But you need to always keep in mind that an NFT’s value is entirely based on what other people are willing to pay for it.

Hence, demand will drive the price instead of fundamental, technical, or financial indicators, which usually impact stock prices and form the basis for investor demand. This means a non-fungible token may be resale for a lesser amount than you paid for it. Or you might not be able to resell it if nobody needs it.

In addition, NFTs are also dependent on capital gains taxes, like when you sell stocks at a profit. However, as they are considered collectibles, they may not get the exceptional long-standing capital gains rates stocks do. Therefore, although the IRS has not yet ruled what NFTs are assessed for tax purposes, they might be taxed at a higher collectibles tax rate.

The cryptocurrencies used to buy the NFT may also be taxed if they have enhanced value since you purchased them. Therefore, you may need to check in with a tax professional when considering the addition of NFTs to your portfolio.

Several NFT scams have also been reported lately, including the rise of fake marketplaces, unverified retailers often imitating real artists, and selling duplicate copies of their artworks for half price.

Lately, pop culture idol Ozzy Osbourne’s NFT collection CryptoBatz went live. Many complaints have been registered about a possible phishing link shared by the artist that was draining their crypto wallets. Almost 1,330 people had visited the NFT project that was fake. An Ethereum wallet address linked to the scammers had received a series of external transactions adding 14.6 ETH ($40,895).

In an additional incident, an NFT collector, Todd Kramer, said that his collection of 16 Bored Ape Yacht Club (BAYC) NFTs worth $2.28 million was hacked. He noted that NFT marketplace OpenSea had “frozen” the assets for him, including one Clonex, eight BAYC NFTs, and seven Mutant Ape Yacht Club presently estimated at 615 Ether.

Another risk related to NFTs that cannot be swept under the mat is the undeniably negative impact on the atmosphere. For example, crypto mining is done to authenticate transactions, which needs high-powered computers that run at a very high capacity, eventually affecting the environment.

Therefore, before you make any investments in NFTs, it would be worth doing your research, understanding the risks, including that you might lose all of your investing dollars, and proceeding with a healthy dose of caution if you decide to take the plunge.

Frequently Asked Question (FAQ)

Q1. How Can I Buy NFTs?

Many NFTs can only be purchased with Ether, so owning some of this cryptocurrency and collecting it in a digital wallet is basically the initial step. You can then purchase NFTs through any online NFT marketplaces, including Rarible, OpenSea, and SuperRare.

Q2. How do you make money with NFTs?

Making money with NFTs can be tricky. Some financiers and venture capitalists utilize NFTs like stocks and turn a profit by buying and selling them. However, if you have already purchased a collection of NFTs and don’t want them any longer, you can quickly sell them the similar way you would if you were to build them yourself.

Q3. Are Non-Fungible Tokens Safe?

Non-fungible tokens that use blockchain technology (just like cryptocurrency) are usually safe. The dispersed nature of blockchains makes NFTs tough (although not impossible) to hack. One security risk for NFTs is that you could lose access to your NFT if the platform hosting the NFT goes out of business.

Q4. What Are Some Examples of NFTs?

Non-fungible tokens can represent any asset digitally, including online-only assets like digital artwork and tangible assets such as real estate. In addition, NFTs can convey other assets, including in-game items like avatars, digital and non-digital collectibles, domain names, and event tickets.

Q5. Are NFTs worth it?

NFTs are valued because they confirm the legitimacy of a non-fungible asset which makes these assets unique and one of a kind. While anyone can make copies of his artwork, the original remains unique and irreplaceable.

Conclusion

Knowing what NFT is can be vast, but owing to the versatile nature of the virtual environment, NFT might be the key to unlocking the massive gold hidden in the core and mantle of the digital sphere. However, like any new technology, it’s difficult to predict how developers, creators, and businesses will utilize NFTs and their innovative underlying smart contracts.

For example, we might see NFTs used for tracking ownership of things like real estate, professional licenses, college degrees, event tickets, and myriad other agreements that presently live on pieces of paper.

All of those will take time to come to execution. And in some cases, most people might not even know NFT technology is being used for them. So ultimately, the limit to what is possible with NFTs is up to our vision.

Snehil Masih is a professional technical writer. He is passionate about new & emerging technology and he keeps abreast with the latest technology trends. When not writing, Snehil is likely to be found listening to music, painting, traveling, or simply excavating into his favourite cuisines.

![How to Update and Reinstall Keyboard Drivers on Windows 10/11 [A Guide]](https://wpcontent.totheverge.com/totheverge/wp-content/uploads/2023/06/05062841/How-to-Update-and-Re-install-Keyyboard-Drivers-on-Windows-10.jpg)